Hello all,

I'd like for others to confirm my thoughts and number crunching below:

Summary/Conclusion:

If you are considering buying resale, and are thinking of either buying and holding a short term contract (OKW, BCV, BWV, etc) or buying and eventually reselling a long term contract (AKV, BLT, CCV), the better financial option is to buy and resale the long term contract.

Details:

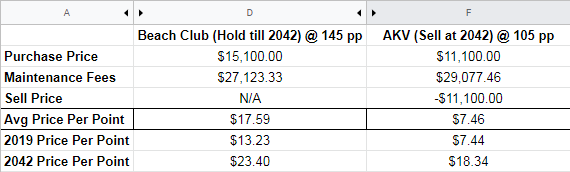

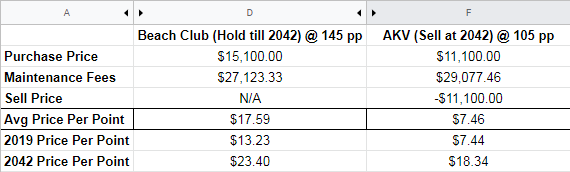

I've been crunching some numbers to look at the differences between buying BCV and holding it until it expires (2042) vs buying AKV and reselling it in 2042. (I don't plan on holding any DVC resort past 2042 as my child will be into his mid 20s by then).

For the purpose of this discussion, I am using:

If you resell at the same price as you bought, it means that the only costs you had during the time you held it was just the maintenance fees. If instead you hold, the you paid the maintenance fees and you never recoup the initial purchase funds. (Of course, this assumes you can get the same price, though given that there should still be 15-18 years left on the long term contract and that the resell prices are somewhat dependent on direct prices, this is not an unreasonable assumption).

You can see in the table below, that for a Buy and Hold at BCV, your 2019 price per point is $13.23, which the annual dues per point ($6.94) + the initial price divided by years of contract divided by points ($6.29).

Now if you compare that to AKV, your 2019 price per point ($7.44) ends up being equivalent to your only your 2019 annual due because you end up recouping your initial funds in 2042.

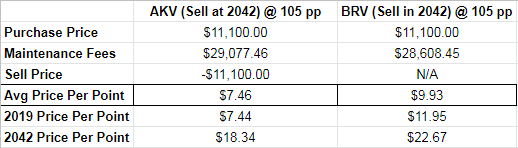

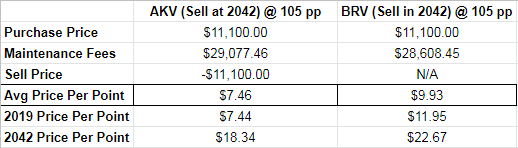

Also reran the numbers using similarly priced resort WL/BRV to better illustrate the savings per a request below:

There is a 25% savings in this example if you simply choice a longer term resort and then resell in 2042 vs holding a 2042 contract until expiration!

So given two resorts that you like equally and do not plan on holding past 2042, the better choice is to take the longer term contract.

Do you agree?

I'd like for others to confirm my thoughts and number crunching below:

Summary/Conclusion:

If you are considering buying resale, and are thinking of either buying and holding a short term contract (OKW, BCV, BWV, etc) or buying and eventually reselling a long term contract (AKV, BLT, CCV), the better financial option is to buy and resale the long term contract.

Details:

I've been crunching some numbers to look at the differences between buying BCV and holding it until it expires (2042) vs buying AKV and reselling it in 2042. (I don't plan on holding any DVC resort past 2042 as my child will be into his mid 20s by then).

For the purpose of this discussion, I am using:

- 100 points resale at each resort,

- $600 closing costs,

- 145 price/point at BCV and 105 price/point at AKV,

- Maintenance fees increasing 4% each year

- Assuming AKV will be sold at 105 pp in 2042 when there is still 15 years left on contract

- Ignoring time value of $ since I do not plan on investing these funds, and this is really a comparison between two DVC alternatives

If you resell at the same price as you bought, it means that the only costs you had during the time you held it was just the maintenance fees. If instead you hold, the you paid the maintenance fees and you never recoup the initial purchase funds. (Of course, this assumes you can get the same price, though given that there should still be 15-18 years left on the long term contract and that the resell prices are somewhat dependent on direct prices, this is not an unreasonable assumption).

You can see in the table below, that for a Buy and Hold at BCV, your 2019 price per point is $13.23, which the annual dues per point ($6.94) + the initial price divided by years of contract divided by points ($6.29).

Now if you compare that to AKV, your 2019 price per point ($7.44) ends up being equivalent to your only your 2019 annual due because you end up recouping your initial funds in 2042.

Also reran the numbers using similarly priced resort WL/BRV to better illustrate the savings per a request below:

There is a 25% savings in this example if you simply choice a longer term resort and then resell in 2042 vs holding a 2042 contract until expiration!

So given two resorts that you like equally and do not plan on holding past 2042, the better choice is to take the longer term contract.

Do you agree?

Last edited: