wabbott

DIS Veteran

- Joined

- Aug 4, 2021

https://www.yahoo.com/entertainment/sean-bailey-disney-legacy-reanimation-140000855.html

Sean Bailey’s Disney Legacy: Reanimation and Later, Exhaustion | Analysis

by Drew Taylor

Wed, March 6, 2024 at 8:00 AM CST

In October of 2010, at a lavish and intimate New York City press event dubbed the Walt Disney Studios Holiday Showcase, Disney treated studio personnel, press and tastemakers to a screening of new footage, including from “Tron: Legacy.”

Introducing the footage was Sean Bailey, the movie’s charismatic producer who had been appointed president of Walt Disney Studios Motion Picture Production 10 months earlier.

The event — showcasing the long-awaited sequel to a groundbreaking Disney classic made, like the original with cutting-edge technology — was a perfect introduction to Bailey, whose tenure at the company would be defined by mining beloved IP with high-tech upgrades.

He’s now set to exit the Walt Disney Company, bringing an end to a nearly decade and a half tenure that at once reinvigorated and exhausted the studio’s live-action output. He had proved keenly able to accomplish things that eluded previous regimes, plumbing Disney’s past as a way of preserving its future. But in the end, Bailey was a victim of his own oversized success, as the studio’s run of wildly successful live-action remakes started to go bust.

“Sean Bailey was a champion who was saddled with the thankless task of supervising the animation remakes that managed to damage the legacy titles and diminish the brand,” a filmmaker who worked with Disney during Bailey’s tenure told TheWrap.

It seemed like a good idea at the time.

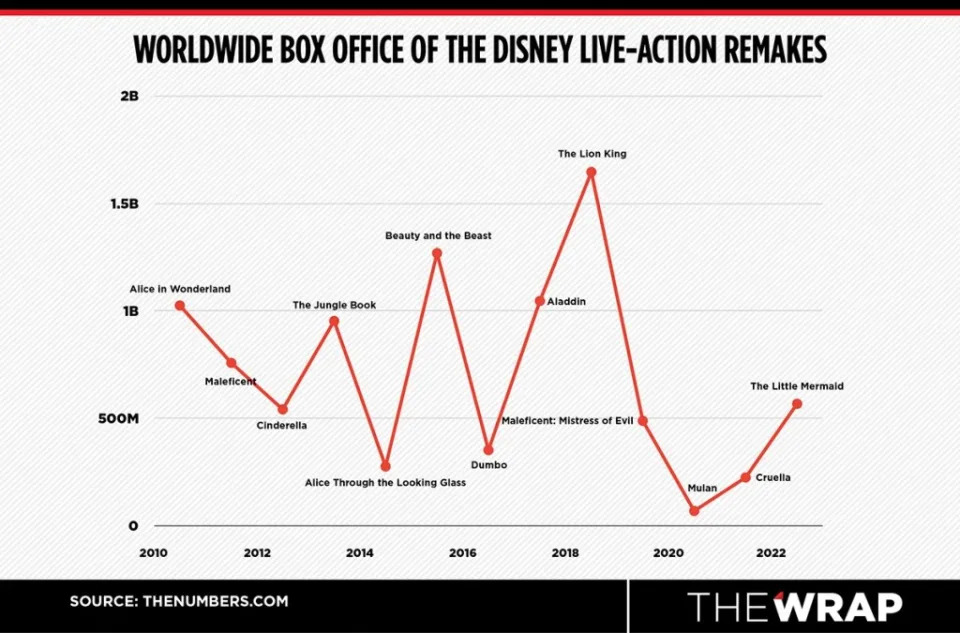

Disney had experimented in the 1990s with live-action remakes to their animated titles, most successfully with a John Hughes-penned “101 Dalmatians” starring Glenn Close. But it had been 10 years since the last attempt. The success of “Alice in Wonderland” opened new opportunities, as Bailey turned to the company’s vault for an entirely new cinematic universe. He didn’t greenlight “Alice in Wonderland,” but he turned it into a certifiable formula.

“We thought if Iron Man and Thor and Captain America are Marvel superheroes, then maybe Alice, Cinderella, Mowgli, and Belle are our superheroes, and Cruella and Maleficent are our supervillains,” Bailey told me in 2017 of his approach to the live-action remakes that became a staple of the studio throughout the 2010s. “Maybe if there’s a way to reconnect with that affinity for what those characters mean to people in a way that gets the best talent and uses the best technology, that could become something really exciting. It feels very Disney, playing to the competitive advantages of this label.”

After “Alice,” a plan came together — there would be a “Sleeping Beauty” live-action remake told from the point of view of the self-described Mistress of Evil, “Maleficent” (played by Angelina Jolie). Tim Burton was courted to direct; when he turned it down, Disney went for his production designer Robert Stromberg. It was a borderline-disastrous shoot, with an additional director brought in for reshoots and a storyline that so radically changed that journalists who attended a set visit were banned from reporting what they saw. The movie nevertheless made almost $800 million worldwide and inspired a sequel years later.

Bailey was going to follow this “fractured fairy tale” approach — telling a familiar story from a different angle — for a planned version of “Cinderella” where Cinderella was left for dead in a forest, forced to befriend a rogue knight and stop a wedding that was of political importance to the kingdom. But Disney scrapped that after much development and instead opted for a more faithful remake, hiring Kenneth Branagh to give it some weight. It made more than $500 million and proved that a live-action remake of a Disney animated classics wasn’t just a fluke — it was now a franchise.

There were some tenuous moments as Bailey tried to mount this new array of live-action features. Oftentimes, he and his team wouldn’t communicate which animated properties they were planning to adapt, which chafed at the folks at Walt Disney Animation Studios, several Disney insiders told TheWrap. These wounds would heal, with Bailey and his team not only alerting the animation studio but also relying on them heavily, after the animation teams’ feelings were known.

The “Alice in Wonderland” sequel, “Alice: Through the Looking Glass,” shows how closely they had aligned. Not only were filmmakers given access to the vast Disney animation archive but a single merchandise push celebrated both the new movie and the animated classic. Internally, it was known as the “Uber Alice” approach.

Other live-action adaptations followed — Jon Favreau’s technically inventive “The Jungle Book,” another “Alice,” and a nearly shot-for-shot remake of “Beauty and the Beast” that cost a fortune (at the time it was the most expensive musical Hollywood had ever produced, with a $255 million budget) and earned even more ($1.27 billion worldwide).

By 2019, Bailey and his team had released five live-action adaptations of Disney animated classics — two of them made over $1 billion (“Aladdin” and “The Lion King”), one disappointed (Tim Burton’s take on “Dumbo,” significantly rejiggered at the 11th hour and leaving Burton with a bad taste in his mouth) and one debuted alongside the company’s premiere direct-to-consumer streaming platform, Disney+ (“Lady and the Tramp”).

In 2004, Disney purchased the rights to the Muppets characters but didn’t exploit them until Bailey arrived. Under Bailey’s leadership, Disney produced two theatrical movies, although neither hit big – 2011’s “The Muppets” (worldwide gross: $165 million) and 2014’s “Muppets Most Wanted,” which cost more than the first film ($50 million vs. $45 million) and made considerably less ($80.4 million).

He also managed to get a sequel to “Mary Poppins” into theaters, something that the company had been attempting, in earnest, since the late 1980s. “Mary Poppins Returns” finally came out in 2018, with Emily Blunt in the lead and Lin-Manuel Miranda in his first major role following his “Hamilton” success. It made almost $350 million worldwide.

Bailey ticked off more boxes from the list of things nobody else had achieved at the Mouse House. He fulfilled Walt Disney’s dream of adapting Frank L. Baum’s “The Wizard of Oz” books with the Sam Raimi-directed “Oz the Great and Powerful” in 2013, although its nearly $500 million gross wasn’t enough to follow through with a planned theme park expansion. He had Steven Spielberg direct a movie for Disney (“The BFG”), made a film that involved Walt Disney himself (“Saving Mr. Banks”) and finally got a starry version of “Into the Woods” to the big screen after more than 15 years of development at various studios.

He elongated the “Pirates of the Caribbean” franchise after the conclusion of the initial trilogy to the tune of another $1 billion (“On Stranger Tides”) and $750 million (“Dead Men Tell No Tales”), respectfully. And he continued to give the go-ahead to so-called “brand deposit” movies — projects that might not make a ton of money but contribute to the value of the company and the Disney name, like the inspiring baseball story “Million Dollar Arm” and the real-life chess underdog film “Queen of Katwe.”

There were bumps along the way for sure, including Gore Verbinski’s costly “The Lone Ranger” (which was given the go-ahead by a previous regime), the live-action debut “John Carter” (ditto) from “Finding Nemo” director Andrew Stanton and Brad Bird’s George Clooney-led “Tomorrowland.” The latter was a high-concept sci-fi adventure that was meant to open up a new universe of interconnected stories and enliven the futuristic section of the Disney parks. “Tomorrowland” grossed $200 million against a budget around $190 million. But it was proof that Bailey wasn’t always interested in the easy lay-up, and supported artists who he believed in on projects that colored outside the lines.

In Burbank, Bailey’s office is lined with framed photographs from the movies he’s produced. He asks the filmmakers to deliver him a single image that speaks to the entire film. Maybe it was from a particularly arduous sequence. Maybe it’s just one that makes them smile. But they all hang, beautifully arranged, in his office. The only person to buck convention was Bird, who instead gave Bailey three images from “Tomorrowland.”

Given that the film underperformed in a pretty big way, it’d be easy to imagine an executive hiding that one in a drawer. But Bailey didn’t retrench. He put them up on the wall, where the framed photos stayed to this day.

The pandemic further complicated the ramp up, with several live-action Disney titles originally meant for theatrical exhibition (like “The One and Only Ivan” and “Artemis Fowl”) going straight to Disney+. Others, like “Jungle Cruise” (Bailey’s attempt at extending the based-on-a-theme-park ride concept that made “Pirates of the Caribbean” such a sensation) and live-action adaptation “Cruella,” premiered simultaneously in theaters and on Disney+ with a surcharge.

Disney’s live-action “Mulan,” which gained unwanted controversy for the decision to shoot in an area of China known for the persecution of the country’s Uighur minority, was another one of these hybrid releases. It made less than $70 million theatrically on a budget of more than $200 million. While much of “Mulan’s” underperformance can be attributed to outside forces (the controversy, the pandemic), it was also clear that something was amiss. Instead of hewing close to the goofy, charming, semi-musical historical fantasy of the animated feature, this was a straightforward kung fu epic.

Following a pair of direct-to-streaming efforts that barely registered (Robert Zemeckis’ “Pinocchio” and David Lowery’s wonderful “Peter Pan & Wendy”), Disney (and Bailey) thought it had an ace up its sleeve: “The Little Mermaid.” It was an iconic Disney title that helped kick off the animation studio’s creative renaissance. It should’ve been a slam dunk.

At the world premiere in Los Angeles last year, director Rob Marshall said he had been toiling away on the movie for more than five years. They had shot (and re-shot) during the pandemic and were finally here. The movie cost more than $200 million to produce. Internally, Disney thought it could crack $1 billion worldwide. It wound up with $569 million — a far cry from the halcyon days of “Beauty and the Beast” and “The Lion King.”

The ride, it appeared, was over.

Faced with diminishing returns and a Disney vault of IP to mine that was getting emptier, a fresh approach was needed.

What now?

A number of live-action adaptations will still see the light of day. A “Lion King” prequel/sequel called “Mufasa: The Lion King,” directed by Barry Jenkins, is out this Christmas. There’s a new “Snow White” out next spring that enlisted Greta Gerwig to work on the script. And a “Lilo & Stitch” remake from “Marcel the Shell with Shoes On” director Dean Fleischer Camp is currently in production. Plus, there’s the live-action “Moana,” with Dwayne Johnson (Bailey’s partner in Teremana Tequila) reprising his role as Maui, scheduled to shoot later this year.

Beyond that, things get hazier. Bailey had lined up a “Cruella” sequel (with Emma Stone set to return), a live-action “Hercules” from Guy Ritchie, and a version of “The Aristocats” directed by Questlove. Additionally, TheWrap has exclusively learned that Sarah Polley is no longer directing a new version of “Bambi.” It’s unclear if the project will move forward now that Bailey is gone.

Iger said on Tuesday at a Morgan Stanley investor conference that Disney had “killed a few projects already that we just didn’t feel were strong enough.” Could corporate mandates have offed Bambi’s mother this time?

David Greenbaum will replace Bailey under a mandate from Iger to make fewer, better movies. A former co-head of Searchlight Pictures, the indie division of 20th Century, Greenbaum oversaw major awards players like “The Shape of Water,” “12 Years a Slave” and “Slumdog Millionaire.” In his new role, he will be president of Disney live-action and 20th Century Studios.

This year Greenbaum is responsible for “Poor Things,” which racked up 11 Oscar nominations and was widely praised as one of the year’s very best movies. Internally, Disney was wowed by the film – it’s visually dazzling, emotionally resonant and actually says something about the world (through a prism of fantasy and sci-fi).

Before he left, Bailey was planning to do more theme park-based projects. In addition to a “Jungle Cruise” sequel, Bailey was looking to revive the “Pirates of the Caribbean” franchise (“Last of Us” creator Craig Mazin was working on a new take). Over the years, scripts based on the Matterhorn, Space Mountain and Tower of Terror (with Taika Waititi attached as director) had been commissioned, with little movement. Will they finally see the light of day? Or will Greenbaum take things in an entirely different direction?

Bailey was never a contender to take over for Bob Iger, who is still supposedly retiring in 2026. Instead, he had to look after his own Magic Kingdom, full of the flesh-and-blood embodiments of everybody’s favorite princesses. And, somewhat ironically, he will return as a hands-on producer on “Tron: Ares,” the long-awaited third film in the series, currently filming in Vancouver.

Bailey’s impact on the studio — for better and worse — cannot be overstated. He combed through the company’s back catalog and came out with an entirely new type of live-action Disney movie that sustained the company for nearly a decade. Even if the gambit had run its course by the time he stepped down, it still made an impact. Rival studios DreamWorks and Universal, for example, are currently at work on a live-action “How to Train Your Dragon” adaptation.

But hey, every fairy tale has to end at some point, right?

The post Sean Bailey’s Disney Legacy: Reanimation and Later, Exhaustion | Analysis appeared first on TheWrap.

Sean Bailey’s Disney Legacy: Reanimation and Later, Exhaustion | Analysis

by Drew Taylor

Wed, March 6, 2024 at 8:00 AM CST

In October of 2010, at a lavish and intimate New York City press event dubbed the Walt Disney Studios Holiday Showcase, Disney treated studio personnel, press and tastemakers to a screening of new footage, including from “Tron: Legacy.”

Introducing the footage was Sean Bailey, the movie’s charismatic producer who had been appointed president of Walt Disney Studios Motion Picture Production 10 months earlier.

The event — showcasing the long-awaited sequel to a groundbreaking Disney classic made, like the original with cutting-edge technology — was a perfect introduction to Bailey, whose tenure at the company would be defined by mining beloved IP with high-tech upgrades.

He’s now set to exit the Walt Disney Company, bringing an end to a nearly decade and a half tenure that at once reinvigorated and exhausted the studio’s live-action output. He had proved keenly able to accomplish things that eluded previous regimes, plumbing Disney’s past as a way of preserving its future. But in the end, Bailey was a victim of his own oversized success, as the studio’s run of wildly successful live-action remakes started to go bust.

“Sean Bailey was a champion who was saddled with the thankless task of supervising the animation remakes that managed to damage the legacy titles and diminish the brand,” a filmmaker who worked with Disney during Bailey’s tenure told TheWrap.

It seemed like a good idea at the time.

Once upon a time…

A few weeks into Bailey’s tenure, the studio released “Alice in Wonderland,” a live-action version of the studio’s 1951 animated classic festooned with elaborate visual effects and released in eye-popping 3D mere months after “Avatar” had become a phenomenon. A homecoming of sorts for director Tim Burton, who had started his career in the studio’s animation department, the movie was a huge hit and made $1 billion worldwide.Disney had experimented in the 1990s with live-action remakes to their animated titles, most successfully with a John Hughes-penned “101 Dalmatians” starring Glenn Close. But it had been 10 years since the last attempt. The success of “Alice in Wonderland” opened new opportunities, as Bailey turned to the company’s vault for an entirely new cinematic universe. He didn’t greenlight “Alice in Wonderland,” but he turned it into a certifiable formula.

“We thought if Iron Man and Thor and Captain America are Marvel superheroes, then maybe Alice, Cinderella, Mowgli, and Belle are our superheroes, and Cruella and Maleficent are our supervillains,” Bailey told me in 2017 of his approach to the live-action remakes that became a staple of the studio throughout the 2010s. “Maybe if there’s a way to reconnect with that affinity for what those characters mean to people in a way that gets the best talent and uses the best technology, that could become something really exciting. It feels very Disney, playing to the competitive advantages of this label.”

After “Alice,” a plan came together — there would be a “Sleeping Beauty” live-action remake told from the point of view of the self-described Mistress of Evil, “Maleficent” (played by Angelina Jolie). Tim Burton was courted to direct; when he turned it down, Disney went for his production designer Robert Stromberg. It was a borderline-disastrous shoot, with an additional director brought in for reshoots and a storyline that so radically changed that journalists who attended a set visit were banned from reporting what they saw. The movie nevertheless made almost $800 million worldwide and inspired a sequel years later.

Bailey was going to follow this “fractured fairy tale” approach — telling a familiar story from a different angle — for a planned version of “Cinderella” where Cinderella was left for dead in a forest, forced to befriend a rogue knight and stop a wedding that was of political importance to the kingdom. But Disney scrapped that after much development and instead opted for a more faithful remake, hiring Kenneth Branagh to give it some weight. It made more than $500 million and proved that a live-action remake of a Disney animated classics wasn’t just a fluke — it was now a franchise.

There were some tenuous moments as Bailey tried to mount this new array of live-action features. Oftentimes, he and his team wouldn’t communicate which animated properties they were planning to adapt, which chafed at the folks at Walt Disney Animation Studios, several Disney insiders told TheWrap. These wounds would heal, with Bailey and his team not only alerting the animation studio but also relying on them heavily, after the animation teams’ feelings were known.

The “Alice in Wonderland” sequel, “Alice: Through the Looking Glass,” shows how closely they had aligned. Not only were filmmakers given access to the vast Disney animation archive but a single merchandise push celebrated both the new movie and the animated classic. Internally, it was known as the “Uber Alice” approach.

Other live-action adaptations followed — Jon Favreau’s technically inventive “The Jungle Book,” another “Alice,” and a nearly shot-for-shot remake of “Beauty and the Beast” that cost a fortune (at the time it was the most expensive musical Hollywood had ever produced, with a $255 million budget) and earned even more ($1.27 billion worldwide).

By 2019, Bailey and his team had released five live-action adaptations of Disney animated classics — two of them made over $1 billion (“Aladdin” and “The Lion King”), one disappointed (Tim Burton’s take on “Dumbo,” significantly rejiggered at the 11th hour and leaving Burton with a bad taste in his mouth) and one debuted alongside the company’s premiere direct-to-consumer streaming platform, Disney+ (“Lady and the Tramp”).

The Resurrectionist

While live-action remakes of animated Disney classics largely defined Bailey’s tenure, he was also able to return to the past for other properties.In 2004, Disney purchased the rights to the Muppets characters but didn’t exploit them until Bailey arrived. Under Bailey’s leadership, Disney produced two theatrical movies, although neither hit big – 2011’s “The Muppets” (worldwide gross: $165 million) and 2014’s “Muppets Most Wanted,” which cost more than the first film ($50 million vs. $45 million) and made considerably less ($80.4 million).

He also managed to get a sequel to “Mary Poppins” into theaters, something that the company had been attempting, in earnest, since the late 1980s. “Mary Poppins Returns” finally came out in 2018, with Emily Blunt in the lead and Lin-Manuel Miranda in his first major role following his “Hamilton” success. It made almost $350 million worldwide.

Bailey ticked off more boxes from the list of things nobody else had achieved at the Mouse House. He fulfilled Walt Disney’s dream of adapting Frank L. Baum’s “The Wizard of Oz” books with the Sam Raimi-directed “Oz the Great and Powerful” in 2013, although its nearly $500 million gross wasn’t enough to follow through with a planned theme park expansion. He had Steven Spielberg direct a movie for Disney (“The BFG”), made a film that involved Walt Disney himself (“Saving Mr. Banks”) and finally got a starry version of “Into the Woods” to the big screen after more than 15 years of development at various studios.

He elongated the “Pirates of the Caribbean” franchise after the conclusion of the initial trilogy to the tune of another $1 billion (“On Stranger Tides”) and $750 million (“Dead Men Tell No Tales”), respectfully. And he continued to give the go-ahead to so-called “brand deposit” movies — projects that might not make a ton of money but contribute to the value of the company and the Disney name, like the inspiring baseball story “Million Dollar Arm” and the real-life chess underdog film “Queen of Katwe.”

There were bumps along the way for sure, including Gore Verbinski’s costly “The Lone Ranger” (which was given the go-ahead by a previous regime), the live-action debut “John Carter” (ditto) from “Finding Nemo” director Andrew Stanton and Brad Bird’s George Clooney-led “Tomorrowland.” The latter was a high-concept sci-fi adventure that was meant to open up a new universe of interconnected stories and enliven the futuristic section of the Disney parks. “Tomorrowland” grossed $200 million against a budget around $190 million. But it was proof that Bailey wasn’t always interested in the easy lay-up, and supported artists who he believed in on projects that colored outside the lines.

In Burbank, Bailey’s office is lined with framed photographs from the movies he’s produced. He asks the filmmakers to deliver him a single image that speaks to the entire film. Maybe it was from a particularly arduous sequence. Maybe it’s just one that makes them smile. But they all hang, beautifully arranged, in his office. The only person to buck convention was Bird, who instead gave Bailey three images from “Tomorrowland.”

Given that the film underperformed in a pretty big way, it’d be easy to imagine an executive hiding that one in a drawer. But Bailey didn’t retrench. He put them up on the wall, where the framed photos stayed to this day.

Trouble in the Magic Kingdom

2019 was a notable year in Bailey’s tenure not only because Disney was increasing the output of the animation-to-live-action machine but because that was the year that Disney+ went live. Bailey was supervising a suite of new features for the service, most of which have now been removed (things like “Stargirl,” “Timmy Failure: Mistakes Were Made” and “Flora and Ulysses”).The pandemic further complicated the ramp up, with several live-action Disney titles originally meant for theatrical exhibition (like “The One and Only Ivan” and “Artemis Fowl”) going straight to Disney+. Others, like “Jungle Cruise” (Bailey’s attempt at extending the based-on-a-theme-park ride concept that made “Pirates of the Caribbean” such a sensation) and live-action adaptation “Cruella,” premiered simultaneously in theaters and on Disney+ with a surcharge.

Disney’s live-action “Mulan,” which gained unwanted controversy for the decision to shoot in an area of China known for the persecution of the country’s Uighur minority, was another one of these hybrid releases. It made less than $70 million theatrically on a budget of more than $200 million. While much of “Mulan’s” underperformance can be attributed to outside forces (the controversy, the pandemic), it was also clear that something was amiss. Instead of hewing close to the goofy, charming, semi-musical historical fantasy of the animated feature, this was a straightforward kung fu epic.

Following a pair of direct-to-streaming efforts that barely registered (Robert Zemeckis’ “Pinocchio” and David Lowery’s wonderful “Peter Pan & Wendy”), Disney (and Bailey) thought it had an ace up its sleeve: “The Little Mermaid.” It was an iconic Disney title that helped kick off the animation studio’s creative renaissance. It should’ve been a slam dunk.

At the world premiere in Los Angeles last year, director Rob Marshall said he had been toiling away on the movie for more than five years. They had shot (and re-shot) during the pandemic and were finally here. The movie cost more than $200 million to produce. Internally, Disney thought it could crack $1 billion worldwide. It wound up with $569 million — a far cry from the halcyon days of “Beauty and the Beast” and “The Lion King.”

The ride, it appeared, was over.

Faced with diminishing returns and a Disney vault of IP to mine that was getting emptier, a fresh approach was needed.

What now?

A number of live-action adaptations will still see the light of day. A “Lion King” prequel/sequel called “Mufasa: The Lion King,” directed by Barry Jenkins, is out this Christmas. There’s a new “Snow White” out next spring that enlisted Greta Gerwig to work on the script. And a “Lilo & Stitch” remake from “Marcel the Shell with Shoes On” director Dean Fleischer Camp is currently in production. Plus, there’s the live-action “Moana,” with Dwayne Johnson (Bailey’s partner in Teremana Tequila) reprising his role as Maui, scheduled to shoot later this year.

Beyond that, things get hazier. Bailey had lined up a “Cruella” sequel (with Emma Stone set to return), a live-action “Hercules” from Guy Ritchie, and a version of “The Aristocats” directed by Questlove. Additionally, TheWrap has exclusively learned that Sarah Polley is no longer directing a new version of “Bambi.” It’s unclear if the project will move forward now that Bailey is gone.

Iger said on Tuesday at a Morgan Stanley investor conference that Disney had “killed a few projects already that we just didn’t feel were strong enough.” Could corporate mandates have offed Bambi’s mother this time?

David Greenbaum will replace Bailey under a mandate from Iger to make fewer, better movies. A former co-head of Searchlight Pictures, the indie division of 20th Century, Greenbaum oversaw major awards players like “The Shape of Water,” “12 Years a Slave” and “Slumdog Millionaire.” In his new role, he will be president of Disney live-action and 20th Century Studios.

This year Greenbaum is responsible for “Poor Things,” which racked up 11 Oscar nominations and was widely praised as one of the year’s very best movies. Internally, Disney was wowed by the film – it’s visually dazzling, emotionally resonant and actually says something about the world (through a prism of fantasy and sci-fi).

Before he left, Bailey was planning to do more theme park-based projects. In addition to a “Jungle Cruise” sequel, Bailey was looking to revive the “Pirates of the Caribbean” franchise (“Last of Us” creator Craig Mazin was working on a new take). Over the years, scripts based on the Matterhorn, Space Mountain and Tower of Terror (with Taika Waititi attached as director) had been commissioned, with little movement. Will they finally see the light of day? Or will Greenbaum take things in an entirely different direction?

Bailey was never a contender to take over for Bob Iger, who is still supposedly retiring in 2026. Instead, he had to look after his own Magic Kingdom, full of the flesh-and-blood embodiments of everybody’s favorite princesses. And, somewhat ironically, he will return as a hands-on producer on “Tron: Ares,” the long-awaited third film in the series, currently filming in Vancouver.

Bailey’s impact on the studio — for better and worse — cannot be overstated. He combed through the company’s back catalog and came out with an entirely new type of live-action Disney movie that sustained the company for nearly a decade. Even if the gambit had run its course by the time he stepped down, it still made an impact. Rival studios DreamWorks and Universal, for example, are currently at work on a live-action “How to Train Your Dragon” adaptation.

But hey, every fairy tale has to end at some point, right?

The post Sean Bailey’s Disney Legacy: Reanimation and Later, Exhaustion | Analysis appeared first on TheWrap.