https://www.yahoo.com/entertainment/every-major-media-executive-got-130000280.html

What Every Major Media Executive Got Paid in 2023

Lucas Manfredi

Tue, May 7, 2024 at 8:00 AM CDT

During a year in which Hollywood television and film production came to a halt due to the dual strikes, the

lofty pay packages of the entertainment industry’s top brass became a key point of scrutiny.

But according to TheWrap’s annual study of executive pay, while many media and entertainment executives saw a decrease in compensation compared to the previous year, most continued to rake in tens of millions, dwarfing the median earnings of their workforces.

In 2023, 21 top executives amassed $641.82 million in total compensation, up 16% from 2022, our analysis showed.

Topping the 2023 list was Chris Winfrey, CEO of Charter Communications, who pulled in total compensation of $89 million, almost five times as much as 2022, due mostly to stock option awards. Not far behind was Endeavor CEO

Ari Emanuel with nearly $84 million in 2023, a more than three-fold jump due mostly to his dual role as CEO and executive chairman of wrestling and ultimate fighting company TKO Group Holdings.

Among companies that encompass major Hollywood studios, Netflix Co-CEO Ted Sarandos’ $49.8 million in compensation slightly outpaced WBD CEO David Zaslav’s $49.7 million.

Only two women were among 21 top executives TheWrap included in its list — all the rest of which were white men. There were no people of color among them.

Shareholders are given the opportunity to vote on executive pay packages set by companies’ compensation committees. Support for these non-binding “say-on-pay” proposals inched up slightly to 90% in 2023, from 89% in 2022, though more votes ended up in the 70% to 90% average support range,

according to the Conference Board.

“Early 2024 results indicate a strong opening of the year for say-on-pay, with average support of 93% and none of the votes dropping below the 70% threshold,” the organization wrote in a proxy season preview in February. “According to some investors, however, say-on-pay may have outlived its usefulness, especially as an annual exercise.”

The organization added that it is “not encouraging compensation committees to have more periodic and meaningful discussions of what’s working and what isn’t” and that some companies are “seemingly indifferent” about negative say-on-pay votes.

Public companies report executive pay annually, with most filing proxy statements in March or April ahead of annual shareholder meetings. Executive pay involves many factors, including one-time grants issued on an executive’s hire or stock that vests on a company’s initial public offering. Complex accounting rules also mean that an executive’s reported stock compensation may not reflect what they ultimately realize from those equity awards.

Below TheWrap breaks down what each major entertainment executive made in 2023, based on proxy statements filed with the U.S. Securities and Exchange Commission.

Charter Communications: Chris Winfrey

Charter Communications, with

over 32 million customers in 41 states, is the largest cable operator in the United States by subscribers. In his first year as CEO, Chris Winfrey took home $89.07 million in total compensation, up 470% from $15.6 million in 2022 when he was Charter’s CFO. The company’s share price rose 14.9% in 2023.

The package included $8.69 million in stock awards, $74.9 million in option awards, $3.49 million in non-equity incentive compensation and $223,866 in “other” compensation, including $197,952 for personal use of the company airplane.

The median Charter employee made $54,476 in 2023. The ratio for Winfrey’s compensation compared to the median employee was 1,635.2 to 1.

Endeavor Group Holdings: Ari Emanuel

Ari Emanuel’s compensation as CEO of Endeavor hit nearly $84 million in 2023, a 340% surge from

$19.06 million in 2022.

The $83.88 million pay package included a salary of $4.9 million, a $34.65 million bonus, $43.47 million in stock awards and $847,045 in “other” compensation, which reflected $225,000 in incremental costs related to business management and tax advisory services, personal use of the company aircraft, reserved parking and personal cell phone expenses.

The majority of his compensation —

$64.9 million — came from Emanuel’s role as CEO of WWE and UFC parent TKO Group, according to TKO’s proxy filing. When excluding the TKO portion, Emanuel’s Endeavor 2023 pay totaled $18.97 million.

The median Endeavor employee earned $70,841 in total compensation in 2023. The ratio of Emanuel’s compensation compared to the median employee was 1,184 to 1. Excluding his TKO pay, the pay ratio to Endeavor’s median employee would be 281 to 1.

Netflix: Ted Sarandos, Greg Peters, Reed Hastings

After the streamer

made changes to its executive pay policies, Netflix Co-CEO Ted Sarandos saw his total compensation dip 0.9% to $49.8 million in 2023, from $50.29 million in 2022.

His package included a $3 million base salary, $28.3 million in option awards, $16.5 million in non-equity incentive plan compensation and $1.98 million in “other” compensation, including $55,913 for car services, $620,013 for personal use of company aircraft and $1.3 million in residential security costs. By comparison, Sarandos’ 2022 package included a $20 million base salary, $28.5 million in option awards and $1.78 million in “other” compensation.

Netflix Co-CEO Greg Peters, who was

elevated to the role in January 2023 after Reed Hastings stepped down, received $40.1 million in total compensation for the year, up 42.6% from $28.1 million in 2022.

Peters’ package included a $2.89 million base salary, $22.67 million in option awards, $13.9 million in non-equity incentive plan compensation and $620,602 in “other” compensation.

The median Netflix employee made $200,761 in 2023. The ratio of Sarandos and Peters’ compensation to the median employee was 248 to 1 and 204 to 1, respectively.

Hastings, who serves as executive chairman, received $11.2 million in total compensation for the year, down 77.8% from $51 million in 2022. The package included a base salary of $510,962, $10.6 million in option awards and $136,092 in “other” compensation.

Warner Bros. Discovery: David Zaslav and Jean-Briac “JB” Perrette

Warner Bros. Discovery CEO David Zaslav took home $49.7 million in 2023, up 26.5% from $39.2 million in 2022.

The package comprises a $3 million base salary, $23.1 million in stock awards, $22 million in non-equity incentive compensation and $1.6 million in “other” compensation that included $16,800 for a car allowance and $705,182 for personal security costs at his residences and during travel, $767,908 for personal use of corporate aircraft and $106,373 for tax gross-ups associated with business associate and spousal travel at the request of the company that is considered business use.

In remarks on Monday at the Milken Conference, Zaslav argued that CEOs “need to be paid with alignment with shareholders, and the majority of compensation should be aligned with the performance of the stock.” WBD’s share price has fallen 67.4% since the Discovery-WarnerMedia merger in 2022.

The median Warner Bros. Discovery employee earned $171,163. Zaslav’s pay ratio compared to the median employee was 290 to 1.

JB Perrette received $20.14 million in total compensation, up 43.1% from $14.08 million in 2022.

The package included a $2.56 million base salary, $8.76 million in stock awards, $2.2 million in option awards, $5.96 million in non-equity incentive plan compensation and $660,517 in “other” compensation, including $545,596 for tax equalization payments made by the company on behalf of Perrette and $93,649 for associated tax gross-ups.

Comcast: Brian Roberts and Mike Cavanagh

Comcast chairman and CEO Brian Roberts received $35.4 million in total compensation for 2023, up 10.6% from his $32.06 million in 2022.

The pay package included a $2.5 million base salary, $15.02 million in stock awards, $9.2 million in option awards, $8.55 million in non-equity incentive plan compensation and $199,049 in “other” compensation, including $189,049 for personal use of the company-provided aircraft.

Comcast’s median employee received $89,104 in 2023. The ratio of Roberts’ compensation compared to the median employee was 398 to 1.

Comcast president Mike Cavanagh, who took over the role in October 2022 after serving as chief financial officer, received total compensation of $29.58 million in 2023.

The package included a $2.46 million base salary, $11.4 million in stock awards, $7 million in option awards, $8.4 million in non-equity incentive plan compensation and $258,030 in “other” compensation, including $248,030 for personal use of company-provided aircraft.

That marked a 26.9% decrease from the $40.48 million he received in 2022, when he received a special performance-based stock option award of $14.8 million that only becomes exercisable if free cash flow per share growth targets are met over a five-year period.

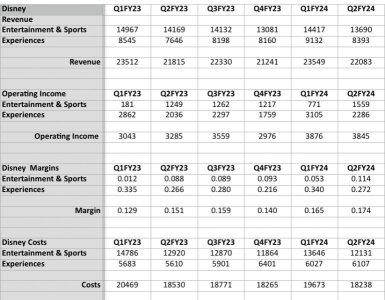

Disney: Bob Iger, Bob Chapek and Christine McCarthy

Disney CEO Bob Iger took in $31.59 million in total compensation for 2023, up 110.6% from $15 million in 2022. Disney shares inched up 1.6% in 2023.

His 2023 package included $865,385 base salary, $16.1 million in stock awards, $10 million in option awards, $2.14 million in non-equity incentive compensation and $2.48 million in “other” compensation, including $793,993 in personal air travel and $1.24 million in security.

The median Disney employee made $54,010 in 2023. The ratio of Iger’s pay compared to the median employee was 595 to 1.

Former Disney CEO Bob Chapek took in $9.94 million in total compensation, down 58.8% from $24.18 million in 2022. His 2023 package included a $673,077 salary, $1.32 million in stock options, $220,581 in non-qualified deferred compensation earnings and $7.72 million in other compensation, including $35,226 in personal air travel and $73,743 in security.

In connection with his termination in November 2022, Chapek also received a cash payment of $6.5 million of his remaining base salary and $1.03 million in the form of a pro-rated target bonus.

Former CFO Christine McCarthy, who stepped down from her role in July to take a family medical leave of absence, took in $18.13 million in 2023, down 10.4% from $20.24 million in 2022.

McCarthy’s package included a $2.05 million salary, $9.95 million in stock awards, $3 million in option awards, $3 million in non-equity incentive compensation and $127,890 in other compensation, including $53,536 for personal air travel. In her capacity as strategic advisor, she received a $517,500 salary for fiscal 2023.

Paramount: Bob Bakish

Former Paramount Global CEO Bob Bakish, who

stepped down from his role last week, received $31.25 million in total compensation in fiscal year 2023, a 2.5% drop from the $32.04 million package he received in 2022.

Bakish’s total pay included a $3.1 million base salary, $15.5 million in stock awards, $12.4 million in non-equity incentive plan compensation, $121,824 to reflect a change in pension value and non-qualified deferred compensation earnings and $100,196 in “other” compensation, which included $79,259 in transportation-related benefits.

The median Paramount employee earned $114,249 in 2023. The ratio of Bakish’s compensation compared to the median employee was 274 to 1.

AMC Entertainment: Adam Aron

AMC Entertainment CEO Adam Aron raked in $25.4 million in total compensation in 2023, up 7% from $23.7 million in 2022.

Aron’s pay package included a $1.5 million base salary, $17.9 million in stock awards and $6 million in non-equity incentive plan compensation.

AMC’s shares plummeted 84% in 2023, largely due to the impact of the strikes, a heavy debt load and the end of a

preferred-stock issuance program.

The median AMC Entertainment employee made $11,555 in 2023. The ratio of Aron’s compensation compared to the compensation of the median employee was 2,201 to 1.

Fox Corporation: Rupert Murdoch and Lachlan Murdoch

Fox Corporation Chairman Emeritus Rupert Murdoch, who announced his

retirement from the role of chairman in September, took home $22.9 million in fiscal 2023, up 24.4% from $18.4 million in fiscal 2022.

The package included a $5 million base salary, $5.8 million in stock awards, $1.75 million in option awards, $4.4 million in non-equity incentive plan compensation, a $5.7 million change in pension value and non-qualified deferred compensation earnings and $200,879 in “other” compensation, including $114,335 for personal use of company-provided aircraft and $25,140 for personal use of a company-provided car.

Fox Corporation chairman and CEO Lachlan Murdoch received $21.8 million in fiscal 2023, up 0.1% from $21.7 million in total compensation for fiscal 2022.

The package included a $3 million base salary, $9.2 million in stock awards, $2.75 million in option awards, $4.4 million in non-equity incentive plan compensation, a $646,000 change in pension value and non-qualified deferred compensation earnings and $1.77 million in “other” compensation. That additional pay included $188,175 for personal use of company-provided aircraft, $14,400 for personal use of a company-provided car and $1.54 million in residential security.

The median Fox employee made $97,491 in 2023. The ratio of Lachlan’s compensation compared to the median employee was 223 to 1.

Lionsgate: Jon Feltheimer

This image has an empty alt attribute; its file name is Jon-Feltheimer-Exec-Pay-2023.jpg

Lionsgate Entertainment CEO Jon Feltheimer took in $21.5 million in total compensation for 2023, up from $5.58 million in 2022 and $19.2 million in 2021.

The package included a $1.5 million base salary, a $10 million bonus, $9.75 million in stock awards and $278,405 in “other” compensation, as well as $15,953 in club membership dues, $29,650 in security service costs, and $218,700 in incremental costs for personal use of a company-leased aircraft.

The median Lionsgate employee made $94,627 in fiscal 2023. The ratio of Feltheimer’s compensation compared to the median employee was 227.5 to 1.

Roku: Anthony Wood and Charles Collier

Roku chairman and CEO Anthony Wood Jr. received $20.2 million in total compensation for 2023, a 3.7% dip from his $20.9 million pay package in 2022.

The package included a $1.2 million base salary, $7.57 million in stock awards and $11.4 million in option awards. In comparison, he received a $1.2 million base salary, $19.8 million in option awards and $16,644 in “other” compensation in 2022.

Roku’s median employee received $253,359 in total compensation in 2023. The ratio of Wood’s compensation compared to the median employee was 80 to 1.

Meanwhile, Roku Media president Charlie Collier saw his total pay drop to $6.84 million in 2023, an 87.2% decrease from the $53.3 million he received in 2022. The falloff was due to Collier not receiving material stock awards or options in 2023.

His 2023 package included a $6.83 million base salary and $18,825 in “other” compensation, which included medical and life insurance premiums paid on his behalf. In 2022, Collier received a base salary of $1.08 million, $23.28 million in stock awards, $28.93 million in option awards and $25,245 in “other” compensation, including a one-time reimbursement paid for $25,000 in attorneys’ fees related to the negotiation of his offer letter.

Pursuant to Roku’s supplemental option program, Wood elected to forego $600,000 and Collier elected to forego $1 million worth of their 2023 base salaries in exchange for monthly grants of vested stock options equal to that amount.

AMC Networks: Kristin Dolan

In her first year as AMC Networks CEO, Kristin Dolan received $14.6 million in total compensation for 2023.

Dolan succeeded CEO Christina Spade, who received total compensation of $21.4 million in 2022. Spade

abruptly stepped down from her position in November after just three months in the role.

Dolan’s CEO package included a $1.65 million base salary, $8.8 million in stock awards, $4.04 million in non-equity incentive plan compensation and $71,750 in “other” compensation, including $49,658 in reimbursements for personal helicopter travel and $13,277 in director compensation.

The median AMC Networks employee received $88,982 in 2023. The ratio of Dolan’s pay compared to the median employee was 164 to 1.

Cinemark: Sean Gamble

Cinemark CEO Sean Gamble received $8.8 million in total compensation for 2023, up 48% from $5.95 million in 2022. The company’s share price ballooned 67% in 2023.

The package included a $900,000 base salary, $5.39 million in stock awards, $2.44 million in non-equity incentive plan compensation and $59,002 in “other” compensation, including $30,251 in dividends paid on restricted stock and vested RSUs.

Cinemark’s median employee made $10,152 in 2023. The pay ratio for Gamble’s compensation compared to the median employee was 867 to 1.

The post

What Every Major Media Executive Got Paid in 2023 appeared first on

TheWrap.