We own 4 contracts - 4 home resorts - 2 were purchased direct, 2 were purchased via resale. In each case, we bought at the best price we could get.

We have never paid over $100 per point, and in the case of our Bay Lake Tower points, we paid direct what the resales are going for in some cases. We bought in one of DVC's lowest direct sale months on record in recent history - and we got a free 7 night cruise with our purchase, plus $$$ per point, and the points were in our account the next morning.

Our third purchase was for Saratoga - we bought resale, for $35 or more less than direct.

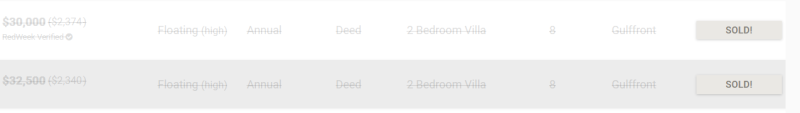

Our last purchase was resale - We wanted HHI points, we had out eye on the resale market for months, and nothing we wanted seemed to be surfacing.

So I called DVC to see if we could buy what we wanted direct.

To say that the guide I spoke to (not our guide, she was out on

DCL that week) but to say that the guide I spoke to could care less is a major understatement. He in fact discouraged me from going on a waitlist for what we wanted - they didn't have any point in our use year on hand, and they weren't in regular habit of buying back HHI points.

At that time the price for HHI was right around $85 I think - and on the resale market we paid less than HALF of that when we eventually found OUR contract. It was more points than what we had planned on buying - but we couldn't pass up the deal!

We are 'done' in the points department - don't think we'll ever be buying more points (DW would kill me :/ )

BUT, nope, I don't think you are cheap - I think you are realistic.... unlike DVC who keeps raising prices.....while prices on the resale market keep dropping!