https://www.hollywoodreporter.com/business/business-news/disney-apple-deal-1235559416/

A Disney Sale to Apple? Don’t Count It Out This Time

Facing the staggering problems afflicting all legacy studios, is Bob Iger contemplating a once-unthinkable option? The signals he sent in Sun Valley suggest that it could happen.

By

Kim Masters,

Alex Weprin

August 9, 2023 4:45am PDT

A few weeks before Bob Iger sat down for that CNBC interview in which he said

Disney’s linear TV networks, like ABC and FX, “may not be core” to the company’s business, a veteran Hollywood executive mused to

The Hollywood Reporter on the possibility of a deal that would rock the industry:

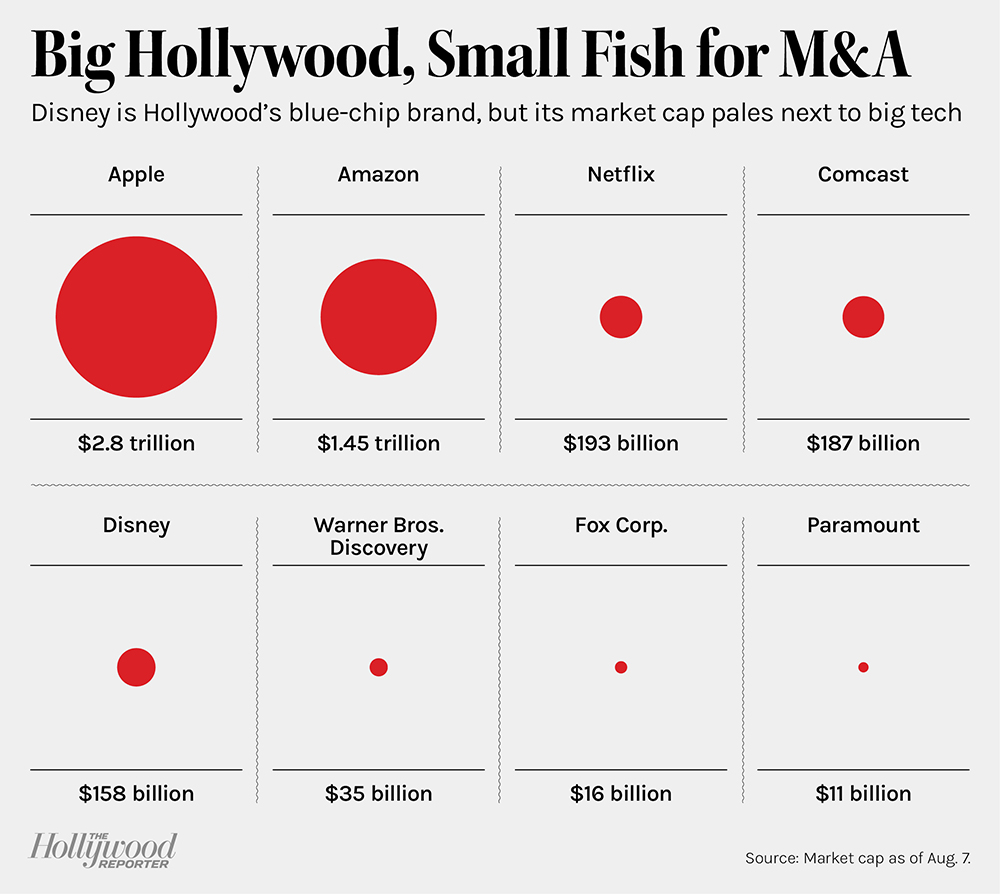

Apple buying Disney. It’s an idea that keeps being discussed, even though many top executives have scoffed at it and many still do. Apple doesn’t want to buy a studio, they say, and there’s no way the feds would allow a huge deal like that to go through.

But this observer wasn’t so quick to rule it out. “I don’t think [Apple] would buy the company as it presently exists,” he said. “But if you see Bob start to divest things … that feels like he’s prepping for a sale. And there’s clearly no buyer like Apple.”

Not long after that, Iger went on television and hung a possibly-for-sale sign on Disney’s TV businesses. And just like that, it was a little more possible to see the outlines of a slimmed-down Disney that could be a tempting acquisition target.

There clearly is no buyer like Apple, which is sitting on $62 billion in cash and cash equivalents and has a $2.8 trillion market cap. And while it may be very true that Apple doesn’t want to buy

a studio, maybe it would want to buy

this studio —the one that, despite the challenges of the moment, has a vault full of priceless IP and remains the most valuable brand in entertainment.

And there has been a long-standing “special relationship” between Disney and Apple: Steve Jobs served on Disney’s board of directors from 2006 until his death in 2011. Iger joined Apple’s board shortly after Jobs died. He resigned from that position Sept. 10, 2019, the same day Apple officially announced that it was getting into the content business through its Apple TV+ service.

Some Hollywood executives have been anticipating a future in which the studio herd will continue to thin — dramatically. “There will end up being three or four platforms and everybody else gets hollowed out and acquired,” says one industry veteran. “There will be Apple,

Amazon, Netflix and one other. If you could put NBCUniversal, Warners and Paramount together, you probably have enough to survive.” (The feds might have something to say about any version of that potential combination.) If Iger sees the world the same way, finding a home for Disney could be a temptation.

Multiple sources say Iger, having returned to the CEO job in November, has never faced more stress. Not only is he confronting an industry in transition, but much of the team that was with him in the good years is no longer at the company: General counsel Alan Braverman and film studio chief Alan Horn have retired. CFO Christine McCarthy, having gotten a bit too close to Bob Chapek during his tenure as CEO, is gone after 23 years at the company.

This may explain Iger’s rapprochement with former top Disney execs Kevin Mayer and Tom Staggs, both of whom were passed over for CEO but who have recently been named as consultants to the company. (The two are partners in their own business, Candle Media.) They know the company well, and not only can they help figure out how to trim Disney+ costs, but they can also assist in a possible sale of the linear TV assets, including the ABC broadcast network and its eight local TV stations, as well as cable channels like Freeform and

National Geographic.

Other holdings, like Disney Channel and Disney Junior, would seem to be of minimal value without the larger company’s content and backing — and FX without the programming hand of John Landgraf and his team would seem to be devalued as well. One knowledgeable observer predicts Disney will “load those assets with debt and sell to private equity.” He believes the properties, which could be expected to generate $7 billion a year in profits, would sell for $50 billion. (Disney’s linear networks generated $8.5 billion in profits in fiscal 2022, though that is expected to decline as cord-cutting continues.) Disney could put $25 billion of Disney debt on the deal, cutting its debt load to $20 billion.

The company is already mulling a sale of the India businesses that it acquired from Fox. And it would not be surprising to see a sale of its majority stake in

Nat Geo (perhaps in conjunction with a sale of the cable channel). Disney’s 50 percent stake in A+E Networks would also likely be available to the right buyer (Hearst owns the other half).

The idea that Disney might sell is top of mind for some Wall Street analysts. Needham & Co. analyst Laura Martin has contended for some time that Disney could sell to Apple. She predicts that Disney “will be purchased during the next three years,” noting that takeover premiums for media companies have typically been in the 30 to 40 percent range. “If they don’t sell, Disney will be competing against those [tech] companies in an industry with deteriorating economics (because they never need to make money from content), we believe,” Martin wrote July 14.

In a research note in June, Martin said that Disney could give Apple the catalyst it needs to drive adoption of its forthcoming Vision Pro augmented reality headset. “The fact that Disney CEO Bob Iger was on stage touting Apple’s Vision Pro goggles demonstrates the compelling strategic fit between Disney’s content and Apple’s wearable technology,” she wrote.

Not everyone is so bullish on a deal. Anthony Sabino, an attorney and professor at St. John’s University (and a self-described “insane Disney fan”), says Iger’s contract extension and potential sale of Disney’s linear TV assets “demonstrates that they [Disney’s board] want him to guide the company, and there’s no thought of him selling off the company.”

Any deal that Disney makes would be sure to invite tough scrutiny from the Biden administration, which has been aggressive in suing to prevent significant deals from being completed, albeit with mixed results.

“It’s a given, it’s an absolute certainty that if there was some talk of Disney merging with somebody else, that would be scrutinized to the nth degree by the FTC, by the Department of Justice,” Sabino says. “So that would be basically walking into a bear trap that I’m not sure any company would be willing to get itself immersed with.” A Republican administration may prove to be more lenient when it comes to a major deal (although it was the Trump administration that tried and failed to stop AT&T’s acquisition of Time Warner).

The actual areas of overlap between Apple and Disney are not that significant — nowhere near the overlap of, say, Disney’s Fox acquisition, which took down a legacy studio. The issue would be the sheer size and power of the combined companies.

But a pair of recent lawsuits, one from the FTC and another from the DOJ, could be relevant to any Disney deal. Most recently, the FTC has faltered in its efforts to block Microsoft’s takeover of the video game publisher Activision Blizzard. It’s a similar situation, with a tech giant and platform owner seeking to acquire what is first and foremost a content company. Microsoft preemptively promised to continue making key games available to competitors like Nintendo and Sony, a decision that was persuasive to the judge in the case, providing a possible road map for a Disney deal with a tech giant.

On the other hand, the Justice Department had a big win when a judge blocked Paramount’s sale of Simon & Schuster to Penguin Random House in 2022. The DOJ made a “monopsony” argument, namely that the merger would be harmful to authors looking to sell their work. With all the logical Disney buyers already owning their own studios, the government could make a similar case, though one source speculated that Disney could offer to preemptively divest some studio assets (like 20th Century Studios and Searchlight Pictures) to keep the level of competition in the market stable and forestall a monopsony case.

Loyal Disney fans, many of whom are shareholders, would be wary of a tech company’s commitment to Disney’s core entertainment and theme park businesses. It’s a group that includes Sabino. “The uproar from Disney shareholders would be insane,” he says. But with more than 1.8 billion shares outstanding, and with more than 60 percent of those shares held by institutional investors, Disney’s retail shareholder fans may not have what it takes to block a deal.

There’s one person who has been thinking about a deal between Apple and Disney for years. In his 2019 memoir,

The Ride of a Lifetime, Iger wrote extensively about his friendship with Jobs, who had founded Pixar and sold it to Disney in 2006. Before there was a pandemic, before he returned from retirement to manage a Disney facing enormous challenges, Iger wrote: “I believe that if Steve were still alive, we would have combined our companies, or at least discussed the possibility very seriously.”