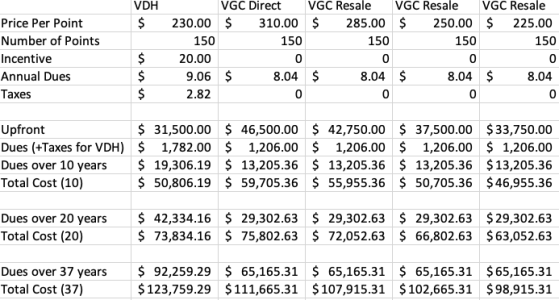

I'm looking for any reason to buy, but am struggling with the numbers.

I view all purchases through the lens of "break even point." The shorter, the better. I realize others approach this differently. But still, I can't make the back-of-the-napkin math work for me on this. Maybe someone can show me the error of my ways...

If we buy 100 points, I'd want to do it in two contracts (50 points each). For simplicity, lets say total closing costs are $1k, so the total initial investment is $24k (at $230 per point).

Based on the

points charts, that likely gets us about 4 to 4.5 stays per year (call it 4.25). If we assign a pre-tax value of $700 per stay, that is $2,975 per year of value. However, between yearly dues (- $900), ToT (-$275), and parking (- $150), the yearly value changes as follows: $2,975 - 900 - 275 - 150 = $1650 of yearly value.

If we divide the initial investment by the yearly value ($24k/$1,650) the break even point is 14.5 years from now. That seems like an awfully long payoff period for a non-essential purchase.

Happy to listen to anyone who crunched the numbers and came up with a better way of looking at it.