Hello Churner Pros! I’ve followed this sub pretty religiously over the past 16+ months and have really appreciated the jump-start information I got when I was nervously dipping my toes in to CC rewards. Thank you for helping me earn so much free travel this last year!

I’m coming to you again for advice. We are looking for a new card for a large spend coming up at the end of the month ($5k). I believe it makes most sense for P2 to get this card, but have some hesitations because we just opened an Amex Gold for him this week (received today!).

Some information:

- $5k spend coming up end of Oct (payment cannot be split so card would need to have $5k+ credit limit)

- P1 has plans to earn SW Companion Pass in early 2023 so laying low for the next month or so to prepare for that (Plans: apply SW Biz early Nov, once Biz card secured, close personal SW card that I've held for 5+ years, wait 30 days?, App SW personal early Jan 23). Assuming this knocks P1 out of play for this upcoming spend?

- P2 just opened Amex Gold this week with the intention of putting that $5k spend on it, but now I'm rethinking that because we will naturally hit that $4k MSR with just organic restaurant and grocery spend over the next 3-6 months so that seems like a better use for meeting that MSR.

- I'd love to open another Chase INK (Unlimited?) card because I'm always thirsty for URs, but I'm not sure if the recent AMEX app messes this up and also not sure if P2's other Chase INKs from the past 13 months will impact an approval?

- ALSO, I need a CL of $5k and all our INKs have had $3-4K initial CLs. I've never attempted to move CLs between my Chase cards and I don't know if it's possible to move a CL to a brand new card or how long this process takes so not sure if I'm unnecessarily worrying about this?

Additional Sticky info:

P1: 3/24

8/22 Chase Ink CIC (#2)

05/22 Chase Hyatt Biz

03/22 Chase Ink CIU

10/21 Chase Ink CIC (#1)

8/21 Amex Plat

4/21 Chase Sapphire P

3/21 Chase Hyatt

P2: 3/24

10/22 Amex Gold

5/22 Chase Ink CIC (#2)

1/22 Chase Ink CIU

9/21 Chase Freedom Flex

9/21 Chase Ink CIC (#1)

5/21 Chase Sapphire P

Other cards we hold, but not within 5/24:

P1:

Costco Citibank

Chase SW Premier

Delta Plat

BoA Alaska Air

P2:

Chase SW Premier

- Monthly CC spend: $3000-4000, with larger spends every couple months between prop tax, tuition, fed tax, etc

- Payoff monthly

- Fly out of SEA or west coast for positioning

- Frequent flyer pref: SW, Delta, Alaska

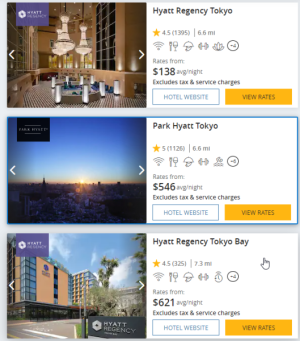

- Hotel pref: Hyatt (Globalist), with Marriott and Hilton distant second

- Travel Points: SW 25k/15k, Hawaiian 70k, Delta 20k, Alaska 10k, Hyatt 50k?, Marriott and Hilton <5k, UR: 600k, MR 185k

- Specific goals: more Hyatt points/more URs/MRs for travel flexibility (I do a lot of mini trips both locally and to AZ/west coast, but also am branching out and planning some more international trips and haven’t exactly figured out travel hacking internationally yet).

- Currently trying to scrape together a June 2023 Europe trip for 4, but would also like to make another 2023 international trip with just P2

- Priorities for P1: re-earn SW companion pass in early 2023 with SUBs, re-earn SW A-list status for 2024, re-earn Hyatt Globalist for 2024 with stays/cc spend (P1 does much more individual travel than P2)

- Priorities for P2: new card that we can put our $5k prop tax spend on before end of Oct, don’t get in way of P1’s priorities

Do we just sit tight and not rock the boat right now- or is there something that could work for this particular spend? Thanks in advance for reading this lengthy post and for anything you can contribute!

Welcome!

I am a HUGE fan of getting a new card for any large spend so think it's awesome you're considering it. Why waste the spend?

Depending in P2's business/"business" , I do think another Ink is within reason-since P2 is still under 5/24 and last Ink was in May, that's 5 months ago so a good cushion. It's easy to send a secure message requesting transfer of CL of $x from Oldest Ink ending in -1234 to Newest Ink ending in -4567 and the change is pretty instant-just ensure the Old Ink doesn't have pending charges/outstanding balances.

Pros-Ink doesn't add to 5/24, no AF, the points are used for Hyatt/SW

Cons-low CL and having to SM

If, for some reason , that doesn't feel right then consider the personal WoH for your P2 (this will likely be in contrast to others who are going to chime in lol)...because it really sounds like you prefer Hyatt and personal cards seem to have higher credit limits than business. The SUB isn't great but the points he earns can be transferred to you (I'm sure you know this) and your concierge can make it happen more quickly if you email him/her the transfer form. You can also "support" P2 and send a link from yours and earn another 5K WoH points.

Pros- more WoH points (always needed LOL), probably a higher CL than a Chase Biz card

Cons-adds to x/24 (P2 would then be at 4/24), it can take some time to receive the card (like 10-14 business days), although you'll earn the SUB (30K points) and "support" (5K points), plus the spend, it's not a great SUB for sure.

Or...I might go completely different direction and recommend either the American Express Blue Business Plus or Business Cash-you could "support" P2 from your Amex Plat (can be a completely different card) and decide whether Membership Rewards is something you want to pursue or cash (that will determine which card P2 obtains). You'll earn MRs for the "support" regardless.

Pros-business card doesn't add to X/24, Amex is usually more generous with credit limits, no Annual Fee for either

Cons- the SUBs aren't fabulous...mmm...I really love my BBP so I can't really think of any more

...perhaps not being approved?

I have faith the rest of the community will have other suggestions