eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

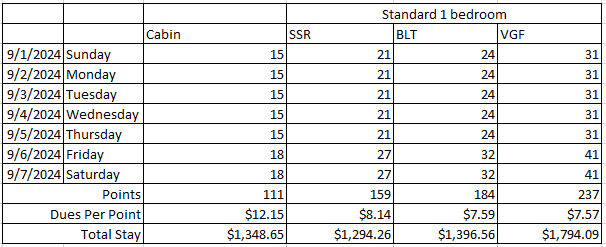

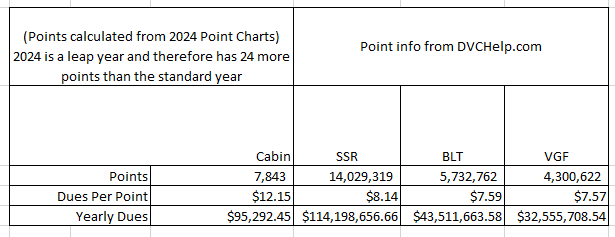

I’m not sure the number of points required per stay really factors into it but I could be wrong. I’m just thinking BLT/VGF/SSR. Those 2 monorail resorts have been historically on the lower end with SSR not that much more. SSR just now went over $8 a point. The amount of points for a SSR stay is lower than BLT or VGF.The dues at Poly2 will probably be quite a bit lower not just because of the building but also because you are going to pay a lot more points per night.

I thought it was more based on the # of points sold at the resort with the second largest Aulani being the exception for insurance.